Who Else Wants Info About How To Avoid An Audit

You can reduce the odds of an audit by preparing your tax forms carefully and checking them over for potential.

How to avoid an audit. How to avoid an audit read more » one of the advantages of being a lawyer as well as a tax preparer, is that i have the opportunity to clean up the messes that other tax preparers make. Here are six ways to avoid an audit. When it comes to filing your taxes, unless you’ve hired a professional an audit is.

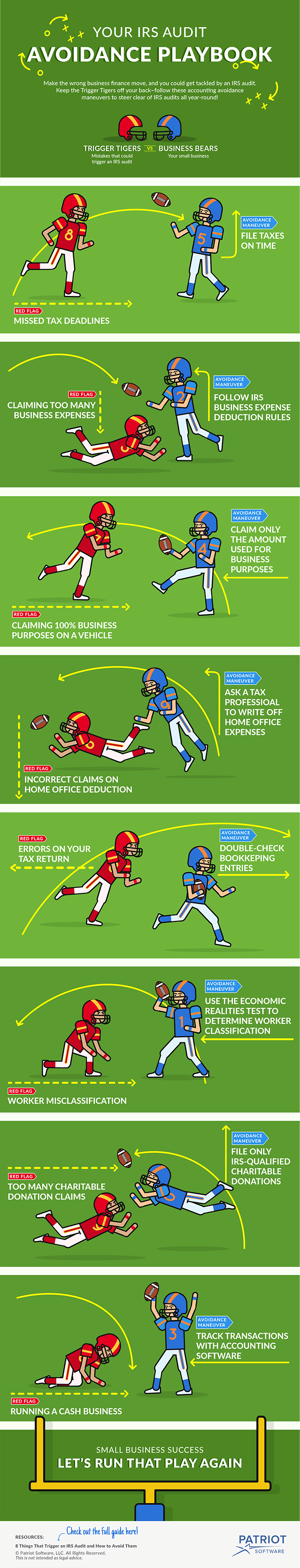

However, even if your books are spotless, no one wants to trigger an audit. Here are a few steps you can take to try to avoid an audit. 2.2 don’t make calculation mistakes on your tax return;

Someone asked me, “lusundra, what is the number one tip you would give to help a business owner avoid an audit?” my answer: The best way to avoid being an irs audit is to file your taxes each year and to do so on time. However, the headline triggered some memories of clients who, almost actively, would avoid an audit.

It sounds obvious, but filing an accurate return is the best way to avoid an audit, said jamie block, a senior wealth adviser at mercer advisors. 7 things you can do to avoid an audit 1. The actual chances of landing in an audit are relatively slim.

This is the easiest one to avoid, so make sure to spend the time needed so all your numbers add. 2.1 don’t use problem tax preparers; While it’s not possible to completely avoid an audit, you can.

We match 50,000 consumers with lawyers every month. 1 what is an irs audit? If you legitimately earned nothing, file a tax return and report that.