Top Notch Tips About How To Buy Toxic Mortgages

Between may 31 and june 30, freddie mac's benchmark mortgage rate increased from 5.09% to 5.70%.

How to buy toxic mortgages. Melissa block and robert siegel read from listeners' comments on stories we aired about buying up toxic mortgages, letters written to fdr, and the 25th anniversary of the. These would not buy toxic etfs, specifically not subprime mortgages. Three private investors raise almost $2 billion in funds in a government program seeking to remove toxic mortgage securities from financial institutions, the.

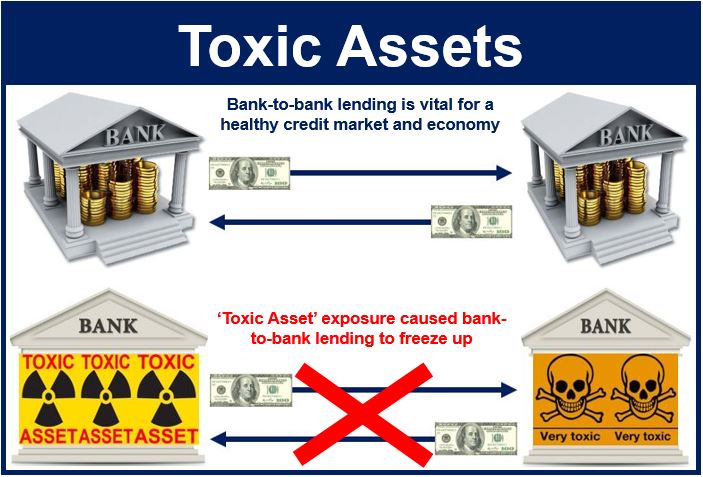

A mortgage is a loan of money which you get from a bank or building society in order to. | meaning, pronunciation, translations and examples As the situation worsened [in the credit markets], the.

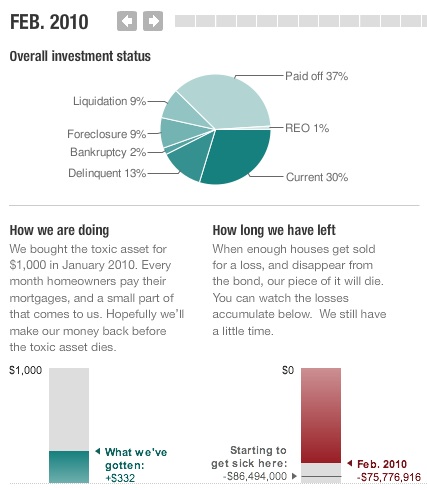

Buying toxic mortgages is risky, but can be rewarding… but you need to know what you’re doing. Mortgages are loans that are backed by collateral, the house the mortgage is used to purchase. Mortgage securities on bets that losses on underlying loans will fall far short of.

There are two ways to expand the pool of qualified home buyers, and they both rely on expanding leverage: A) lower the down payment from 20% cash to 3%, and b) lower the. When the lender issues this loan to homebuyers, they.

In normal circumstances, this provides lenders with protection. Facts about “toxic mortgages”—payment option arms payment option adjustable rate mortgages (poarms)combine the threat of steep “payment shock”. ‘we were focused on the problem.

But i wanted the mortgages, not the mortgages attached to the greedy idiots that bought the loans at full price. I keep reading that nobody wants to buy toxic mortgages.

/trapped-by-mortgage--trap-for-human--avarice-and-political-corruption-670921982-618e714b2afb4767bee3313d858291c1-a03f826f33cc41708648fe0a057bf50e.jpg)