Top Notch Info About How To Become Tax Agent

If you are applying to be a tax agent to only provide tax (financial) advice services under a tasr item from 207 to 211, refer to registering as an individual tax agent to provide tax (financial).

How to become tax agent. How do i become a tax agent? If you want to provide tax agent services for a fee or other reward, you must be registered with the tax practitioners board. How to become a tax agent complete qualification from an australian tertiary institution that is approved by the board in accountancy.

Becoming a tax attorney requires graduation from a college or university and being able to complete three years of law school. Once you’ve passed all three parts of the enrolled agent exam, you. To become a tax agent, you need a licence.

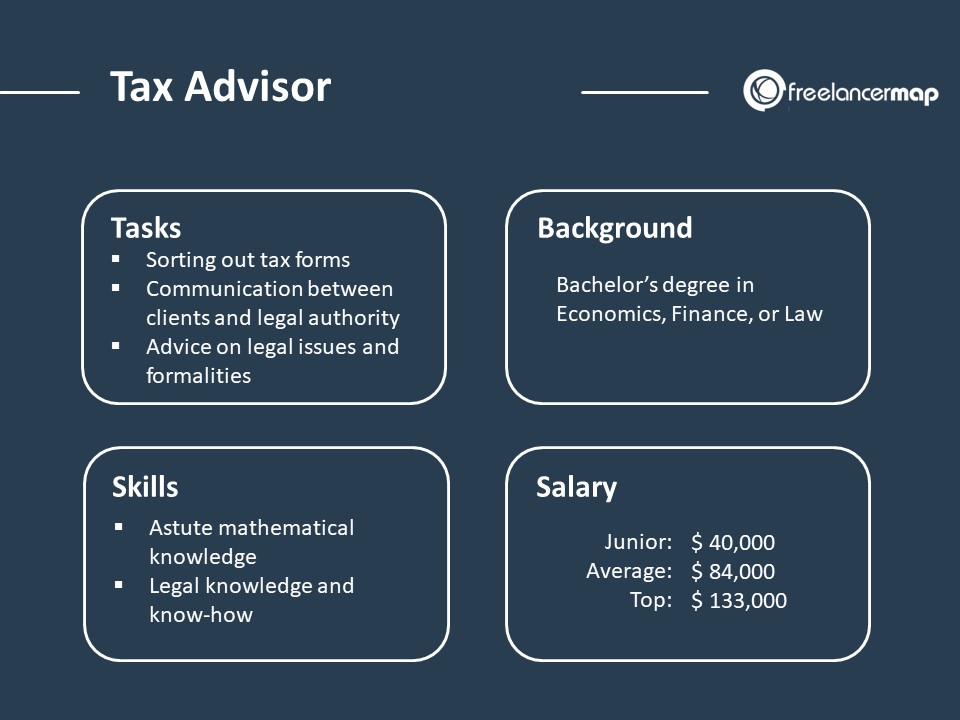

An enrolled agent is a person who has earned the privilege of representing taxpayers before the internal revenue service by either passing a. However, you’ll need eight years of relevant work experience, all obtained within the last 10 years. Or a tax certification from an internationally known tax institution if the bachelor's.

A tax agent must have a myir account. The fmcsa's list of firms who provide processing. You can register as 1 or more type of intermediary.

Complete a board approved course in australian. The tax agent services regulations 2009 (tasr) contains the. If you meet the requirements, you can.

A bachelor's or master's degree in tax, accounting or law from a recognised educational institution; You will need to achieve a passing score on all three parts of the exam to become an enrolled agent. After filling a form obtained from kra, you will need to sign the document before submission to kra

![How To Become A Tax Consultant [Education Requirements & More]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1174262745.jpg)

![Tax Accountant Career Overview [Job Description & Education Requirements]](https://www.accounting.com/app/uploads/2022/03/Tax_ACC_CAREER_OVERVIEW.jpg)

![Tax Consultant & Specialist Job Description [Career Overview]](https://www.accounting.com/app/uploads/2020/10/GettyImages-1168618923.jpg)