Outstanding Tips About How To Get Rid Of Pmi

No snn needed to check rates.

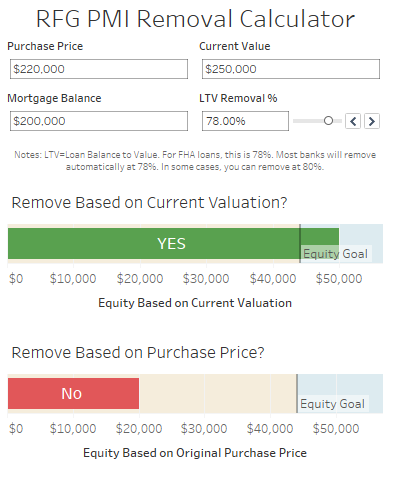

How to get rid of pmi. Refinance to get rid of pmi. Request pmi cancelation once you have 20% in home equity and your mortgage balance is 80% of the loan, you can request your mortgage lender to remove pmi. Ad top refinance companies could help you save on your mortgage.

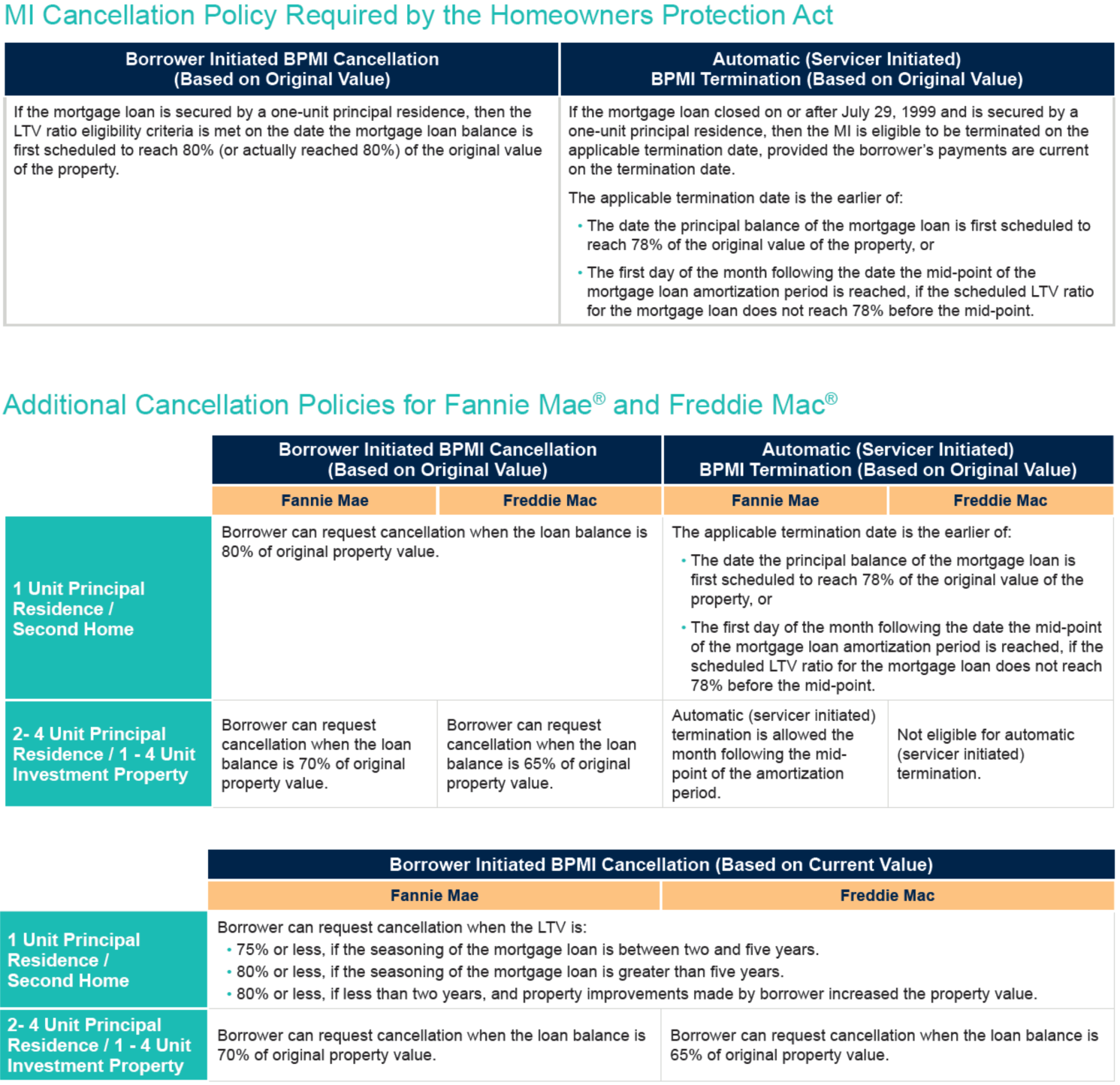

If requested by your lender, confirm that you have no additional loans on the property, such as a home equity loan or home equity line of credit. Ad getting rid of pmi insurance. The federal homeowners protection act (hpa) provides rights to remove private mortgage insurance (pmi) under certain circumstances.

Ad low fixed mortgage refinance rates updated daily. The law generally provides two ways. One way to get rid of mip is with a mortgage refinance.

If the value of your house is $300,000, then pmi should be cancelled when you pay your home loan down to $234,000, even if the loan itself was for $260,000. Request cancellation at a mortgage balance of 80% another tip for how to. Pmi protects mortgage lenders against the risk of default when you make a down payment of less than 20%.

Put your request in writing. When you have a conventional loan, getting rid of pmi is just a matter of waiting. All of this helps to build equity faster and eliminate the pmi payments.

Us residents, qualify today for debt relief without a costly loan! Your lender will cancel pmi once you’ve paid down your original loan. But if you made a small down payment or live in an area where home.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)